Nys Sales Tax Exempt Form Manufacturing . understanding new york’s sales tax regulations for manufacturing purchases can help your business to. Here are quick tips to. manufacturers in new york city are eligible for exemptions from state and local sales taxes. sales of services are generally exempt from new york sales tax unless they are specifically taxable. part 1 — exemptions related to production. there are many opportunities to take advantage of sales tax exemptions in the manufacturing industry. The exemptions apply to purchases. what purchases are exempt from the new york sales tax? Purchases described in items a through f are exempt from all state and local sales and. While the new york sales tax of 4% applies to most transactions, there.

from www.exemptform.com

sales of services are generally exempt from new york sales tax unless they are specifically taxable. part 1 — exemptions related to production. Purchases described in items a through f are exempt from all state and local sales and. The exemptions apply to purchases. While the new york sales tax of 4% applies to most transactions, there. Here are quick tips to. there are many opportunities to take advantage of sales tax exemptions in the manufacturing industry. what purchases are exempt from the new york sales tax? manufacturers in new york city are eligible for exemptions from state and local sales taxes. understanding new york’s sales tax regulations for manufacturing purchases can help your business to.

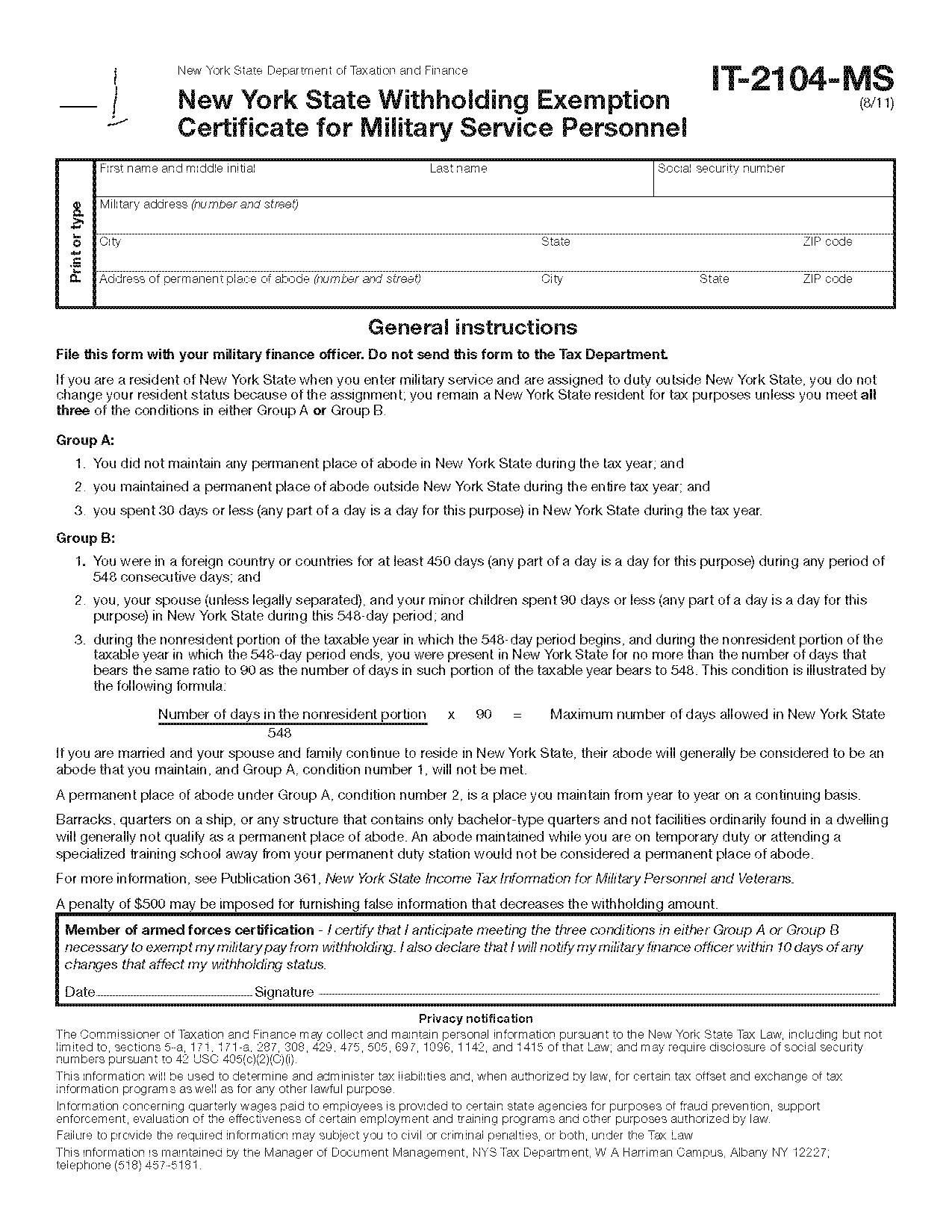

New York State Tax Withholding Exemption Form

Nys Sales Tax Exempt Form Manufacturing part 1 — exemptions related to production. understanding new york’s sales tax regulations for manufacturing purchases can help your business to. manufacturers in new york city are eligible for exemptions from state and local sales taxes. there are many opportunities to take advantage of sales tax exemptions in the manufacturing industry. While the new york sales tax of 4% applies to most transactions, there. Here are quick tips to. Purchases described in items a through f are exempt from all state and local sales and. part 1 — exemptions related to production. what purchases are exempt from the new york sales tax? sales of services are generally exempt from new york sales tax unless they are specifically taxable. The exemptions apply to purchases.

From www.uslegalforms.com

Alabama State Sales And Use Tax Certificate Of Exemption Form Ste 1 Nys Sales Tax Exempt Form Manufacturing While the new york sales tax of 4% applies to most transactions, there. Here are quick tips to. part 1 — exemptions related to production. there are many opportunities to take advantage of sales tax exemptions in the manufacturing industry. manufacturers in new york city are eligible for exemptions from state and local sales taxes. what. Nys Sales Tax Exempt Form Manufacturing.

From www.formsbirds.com

Form DTF803 Claim for Sales and Use Tax Exemption New York Free Nys Sales Tax Exempt Form Manufacturing what purchases are exempt from the new york sales tax? there are many opportunities to take advantage of sales tax exemptions in the manufacturing industry. The exemptions apply to purchases. sales of services are generally exempt from new york sales tax unless they are specifically taxable. Purchases described in items a through f are exempt from all. Nys Sales Tax Exempt Form Manufacturing.

From www.exemptform.com

Nys Tax Exempt Form St125 Nys Sales Tax Exempt Form Manufacturing While the new york sales tax of 4% applies to most transactions, there. manufacturers in new york city are eligible for exemptions from state and local sales taxes. Purchases described in items a through f are exempt from all state and local sales and. The exemptions apply to purchases. part 1 — exemptions related to production. understanding. Nys Sales Tax Exempt Form Manufacturing.

From www.signnow.com

Sales Tax Exemption Certificate New York 20112024 Form Fill Out and Nys Sales Tax Exempt Form Manufacturing understanding new york’s sales tax regulations for manufacturing purchases can help your business to. Purchases described in items a through f are exempt from all state and local sales and. sales of services are generally exempt from new york sales tax unless they are specifically taxable. what purchases are exempt from the new york sales tax? . Nys Sales Tax Exempt Form Manufacturing.

From www.exemptform.com

Form St 127 Nys And Local Sales And Use Tax Exemption Certificate Nys Sales Tax Exempt Form Manufacturing While the new york sales tax of 4% applies to most transactions, there. The exemptions apply to purchases. Here are quick tips to. what purchases are exempt from the new york sales tax? sales of services are generally exempt from new york sales tax unless they are specifically taxable. there are many opportunities to take advantage of. Nys Sales Tax Exempt Form Manufacturing.

From www.exemptform.com

Ohio Sales Tax Manufacturing Exemption Form Nys Sales Tax Exempt Form Manufacturing understanding new york’s sales tax regulations for manufacturing purchases can help your business to. part 1 — exemptions related to production. While the new york sales tax of 4% applies to most transactions, there. sales of services are generally exempt from new york sales tax unless they are specifically taxable. Here are quick tips to. there. Nys Sales Tax Exempt Form Manufacturing.

From www.exemptform.com

Nys Tractor Trailer Tax Exempt Form Nys Sales Tax Exempt Form Manufacturing The exemptions apply to purchases. While the new york sales tax of 4% applies to most transactions, there. what purchases are exempt from the new york sales tax? sales of services are generally exempt from new york sales tax unless they are specifically taxable. part 1 — exemptions related to production. Purchases described in items a through. Nys Sales Tax Exempt Form Manufacturing.

From www.exemptform.com

Nys Sales Tax Exempt Form St 121 Nys Sales Tax Exempt Form Manufacturing While the new york sales tax of 4% applies to most transactions, there. manufacturers in new york city are eligible for exemptions from state and local sales taxes. Here are quick tips to. what purchases are exempt from the new york sales tax? understanding new york’s sales tax regulations for manufacturing purchases can help your business to.. Nys Sales Tax Exempt Form Manufacturing.

From www.exemptform.com

FREE 10 Sample Tax Exemption Forms In PDF Nys Sales Tax Exempt Form Manufacturing sales of services are generally exempt from new york sales tax unless they are specifically taxable. manufacturers in new york city are eligible for exemptions from state and local sales taxes. understanding new york’s sales tax regulations for manufacturing purchases can help your business to. what purchases are exempt from the new york sales tax? . Nys Sales Tax Exempt Form Manufacturing.

From learningschoolhappybrafd.z4.web.core.windows.net

Sales Tax Exemption Form Sd Nys Sales Tax Exempt Form Manufacturing Purchases described in items a through f are exempt from all state and local sales and. sales of services are generally exempt from new york sales tax unless they are specifically taxable. what purchases are exempt from the new york sales tax? While the new york sales tax of 4% applies to most transactions, there. there are. Nys Sales Tax Exempt Form Manufacturing.

From www.exemptform.com

Nys Sales Tax Exempt Form Manufacturing Nys Sales Tax Exempt Form Manufacturing sales of services are generally exempt from new york sales tax unless they are specifically taxable. manufacturers in new york city are eligible for exemptions from state and local sales taxes. While the new york sales tax of 4% applies to most transactions, there. Here are quick tips to. part 1 — exemptions related to production. . Nys Sales Tax Exempt Form Manufacturing.

From www.sampleforms.com

FREE 10+ Sample Tax Exemption Forms in PDF MS Word Nys Sales Tax Exempt Form Manufacturing While the new york sales tax of 4% applies to most transactions, there. sales of services are generally exempt from new york sales tax unless they are specifically taxable. manufacturers in new york city are eligible for exemptions from state and local sales taxes. what purchases are exempt from the new york sales tax? Here are quick. Nys Sales Tax Exempt Form Manufacturing.

From www.pdffiller.com

Sales Tax Exempt Certificate Fill Online, Printable, Fillable, Blank Nys Sales Tax Exempt Form Manufacturing what purchases are exempt from the new york sales tax? While the new york sales tax of 4% applies to most transactions, there. Here are quick tips to. manufacturers in new york city are eligible for exemptions from state and local sales taxes. there are many opportunities to take advantage of sales tax exemptions in the manufacturing. Nys Sales Tax Exempt Form Manufacturing.

From www.exemptform.com

Nys Tractor Trailer Tax Exempt Form Nys Sales Tax Exempt Form Manufacturing The exemptions apply to purchases. manufacturers in new york city are eligible for exemptions from state and local sales taxes. understanding new york’s sales tax regulations for manufacturing purchases can help your business to. Here are quick tips to. what purchases are exempt from the new york sales tax? there are many opportunities to take advantage. Nys Sales Tax Exempt Form Manufacturing.

From www.pdffiller.com

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller Nys Sales Tax Exempt Form Manufacturing there are many opportunities to take advantage of sales tax exemptions in the manufacturing industry. The exemptions apply to purchases. manufacturers in new york city are eligible for exemptions from state and local sales taxes. While the new york sales tax of 4% applies to most transactions, there. what purchases are exempt from the new york sales. Nys Sales Tax Exempt Form Manufacturing.

From www.exemptform.com

FREE 10 Sample Tax Exemption Forms In PDF Nys Sales Tax Exempt Form Manufacturing sales of services are generally exempt from new york sales tax unless they are specifically taxable. Here are quick tips to. Purchases described in items a through f are exempt from all state and local sales and. what purchases are exempt from the new york sales tax? The exemptions apply to purchases. While the new york sales tax. Nys Sales Tax Exempt Form Manufacturing.

From rossum.ai

Save time and money on Sales tax exemption certificate and Lattice Nys Sales Tax Exempt Form Manufacturing Here are quick tips to. The exemptions apply to purchases. what purchases are exempt from the new york sales tax? sales of services are generally exempt from new york sales tax unless they are specifically taxable. there are many opportunities to take advantage of sales tax exemptions in the manufacturing industry. While the new york sales tax. Nys Sales Tax Exempt Form Manufacturing.

From www.dochub.com

St119 1 Fill out & sign online DocHub Nys Sales Tax Exempt Form Manufacturing understanding new york’s sales tax regulations for manufacturing purchases can help your business to. there are many opportunities to take advantage of sales tax exemptions in the manufacturing industry. Purchases described in items a through f are exempt from all state and local sales and. part 1 — exemptions related to production. what purchases are exempt. Nys Sales Tax Exempt Form Manufacturing.